The price of Bitcoin fell from a high of more than $63,000 in mid-April to a low of less than $32,000 at various times in June. Ethereum peaked at over $4,100, only to fall to under $1,800 on Saturday. And while cryptocurrency prices have begun to rebound, the damage seems to have been done when it comes to popular sports NFTs.

Both NBA Top Shot and Topps MLB NFTs have suffered through significant price drops, with both products sitting near their lowest points this year.

Topps prices hold in WAX, drop in USD

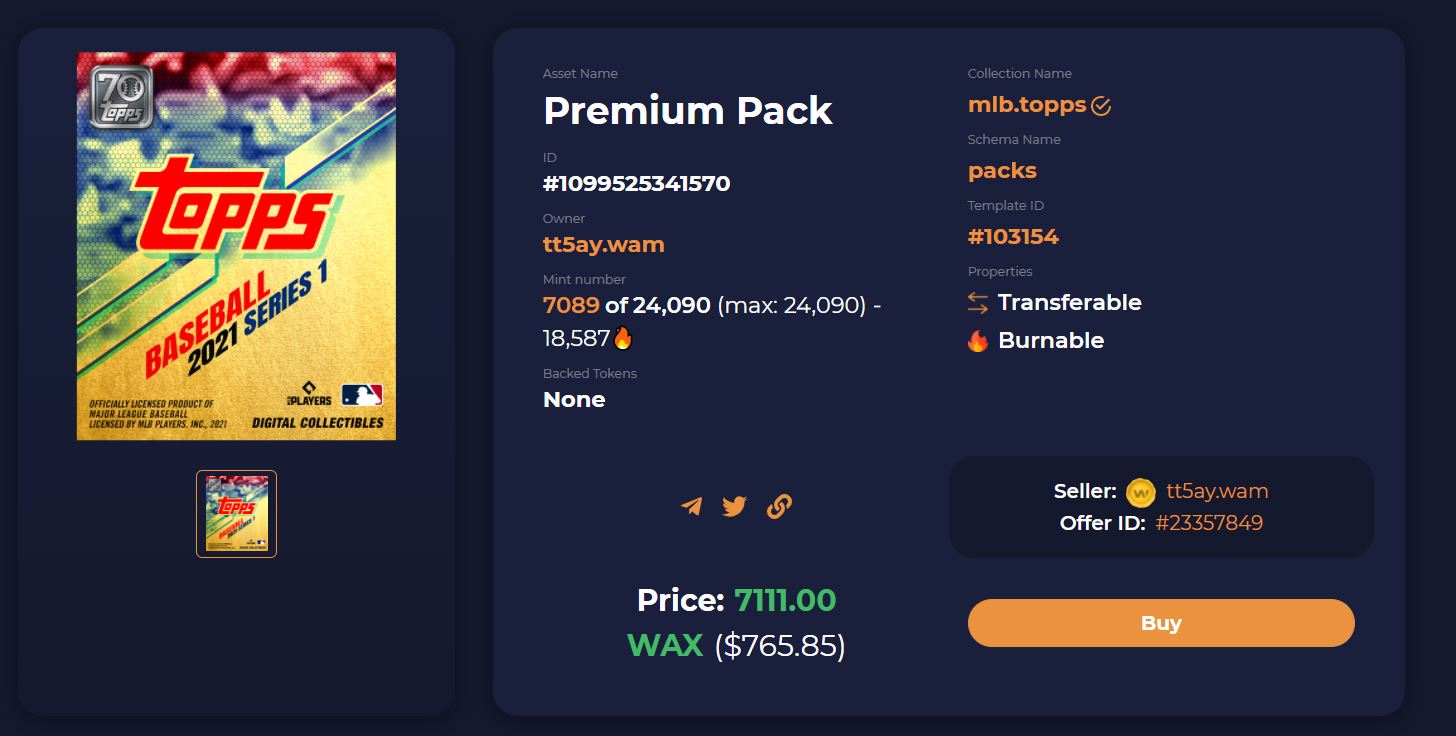

As I’ve discussed before, the Topps MLB sports NFTs are heavily tied into the WAX cryptocurrency. As goes WAX, so go the MLB’s digital collectibles.

That once again became abundantly apparent last week, as WAX fell below $0.09 – far off the $0.28 price it held as recently as early May. While many Topps NFTs held their value in WAX, the US dollar values plunged due to the declining value of the cryptocurrency.

| Topps MLB NFT Pack Median Prices (via AtomicHub) | |||

| June 1 | June 15 | June 29 | |

| Premium Packs | $663.67 (4,175 WAX) | $769.49 (5,450 WAX) | $721.14 (6,730 WAX) |

| Standard Packs | $62.47 (392.99 WAX) | $56.93 (420 WAX) | $50.36 (470 WAX) |

Overall, however, the Topps MLB market still shows some promising signs for the future. Sealed product prices continue to creep up in terms of WAX, and have even remained somewhat resilient in USD. Series 1 Premium Packs, which hold 45 NFTs and can contain exclusive epic and legendary collectibles, are selling for a median price of $721.14 or 6,730 WAX on Tuesday, according to AtomicHub sales data. That’s off the USD high of $826.29 seen on June 16, but well above the 5,399 WAX sales price that represented at the time.

In other words, Topps MLB NFTs appear to be holding their ground – but can only truly do so if WAX maintains or enhances its value going forward.

Top Shot NFTs continue falling from lofty spring heights

Meanwhile, the NBA Top Shot marketplace continues its slow slide. The MR 100 index developed by MomentRanks.com now stands at an all-time low of 1,927.28. That’s down nearly 55% from a mark of 4,244.9 when the index launched on May 8. That trend persists largely across the board, with most moments and sets down significantly since the dramatic highs seen early this spring.

Does this mean disaster for sports NFTs across the board? Not necessarily. While market data doesn’t go back far enough to be sure, it appears that the value of NBA Top Shot moments is still typically higher than the packs they are pulled from. In other words, investors are still largely ahead of the game: they’re just losing much of the massive profits from what increasingly looks like an unsustainable bubble earlier this year.

It’s important to remember that all of these trends are extremely short-term. NBA Top Shot only publicly launched in October 2020, and Topps sold its Series 1 MLB NFTs on April 20, barely over two months ago. Any prediction of the future of these sports NFTs – or NFTs in general – lands squarely in the realm of pure speculation for the moment, and analyzing the current trends could ultimately prove counterproductive when trying to guess how much these products could be worth in the years or decades to come.