Anyone closely following the NFT space has noticed that the market has cooled in recent weeks following a burst of interest in non-fungible tokens earlier this spring. But a recent story by Protos examined just how far interest in these products, including some sports NFTs, has actually fallen.

According to data from NonFungible.com analyzed by Protos, the overall NFT market is down about 90% compared to early May in terms of overall sales volume. But that doesn’t mean that your sports NFTs are suddenly worthless.

Sales drop significantly in May

Protos found that NFT sales peaked on May 3, with $102 million in sales on that one day. Meanwhile, in the last week, sales totaled just $19.4 million. That’s down about 89% from the $170 million in sales during the seven-day period around the early-May peak. Undoubtedly, this points to lower interest in NFTs in general. The Protos article also points out that active wallets are down, as is activity in all sectors of the market, from collectibles to games, art, and even sports.

On May 3, $102M worth of NFTs were sold — the market peak. But only $19.4M sales were processed in the past week.

Data suggests the NFT bubble lasted just four months, and popped this time in May. Here are some graphs to prove it: https://t.co/PpiFHXJpIM

— Protos (@ProtosMedia) June 2, 2021

While those general trends should be of interest to anyone who is considering investing in digital collectibles, there are a couple of reasons why this data may not be quite as catastrophic as it seems for the sports NFT world.

For starters, NonFungible.com only looks at a limited number of NFT products. While the inclusion of Sorare gives its analysis a reasonable sports data point, it doesn’t include the other big names in the sector like NBA Top Shot or Topps MLB. While NonFungible.com lists Zed Run in the sports category, it reports no current sales data for the horse racing game.

Sports NFTs see a more gradual decline

That means we have to look elsewhere for information on sports NFTs. And while the data isn’t exactly encouraging, it does look a bit more like a retracement than a complete collapse. The MarketRanks.com MR 100 – a sort of index based on 100 particular moments in NBA Top Shot – continues to fall since its release on May 8. As of Wednesday evening, it sits at 2175.4, down nearly 49% since the index launched.

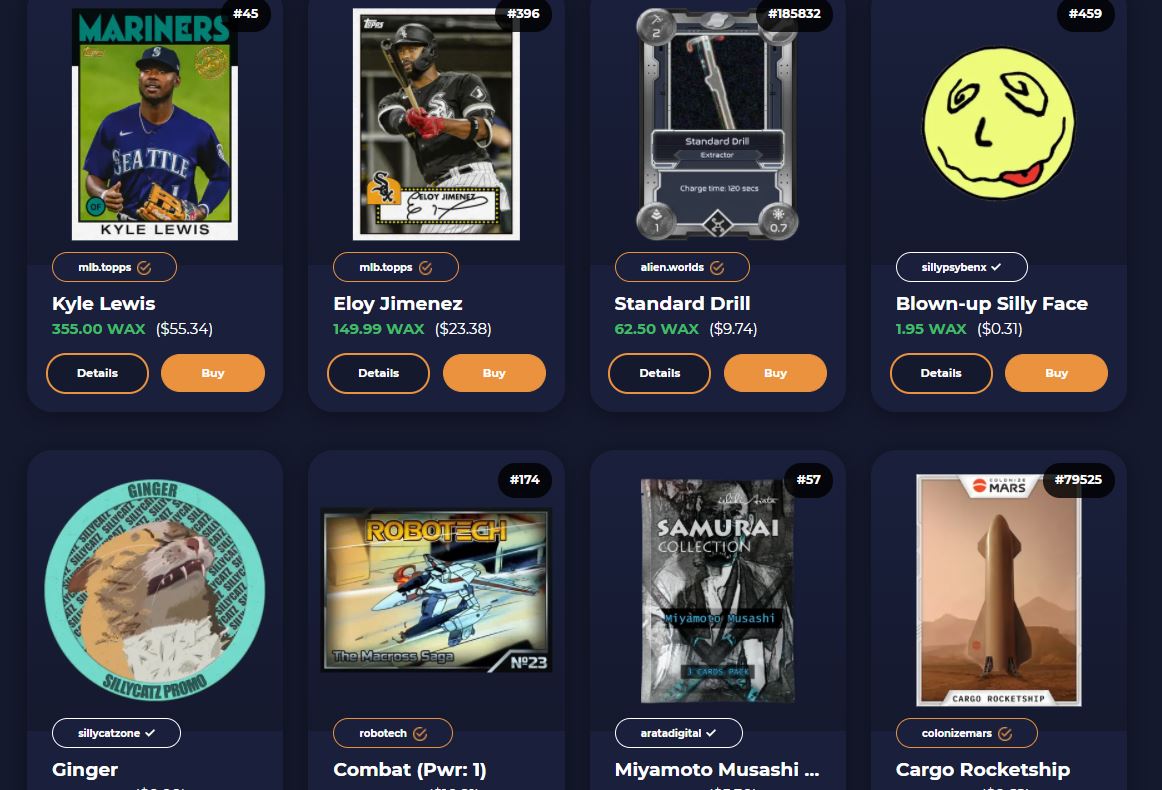

Topps MLB sales volume has continued to be relatively low, with CryptoSlam.io reporting about $4.16 million in sales during the month of May, with numbers heading lower as the Series 1 digital cards drifted further from their late-April release. Still, the average sale price for these NFTs has remained remarkably steady, and the market cap has actually increased from a low of about $15 million to a current total of over $18 million, likely due to a rebound in the price of WAX.

At the moment, the amount of decline in both the NBA Top Shot and Topps MLB markets still means that the moments or cards investors hold are almost all worth far more than the packs they initially came out of – a sign that the market has cooled, but that demand remains higher than supply. Only time will show whether that dynamic remains in play, or if sports NFTs fall the way of digital art prices.