With many sports still in hiatus, sports bettors moved into the next best game in town — the stock market. Galvanized by Barstool Sports’ founder Dave Portnoy, throngs of aggressive novices are driving Wall Street’s institutional investors insane.

Between Feb. 19 to March 23, the stock market tanked roughly 34%. World economies were basically stopped in their tracks by the coronavirus outbreak. To add insult to injury, sports fans couldn’t even while away their idle hours watching sports. On March 11, the NBA pulled the plug on its season, and every major league sport eventually followed suit.

It was arguably one of the worst stock markets of a lifetime. And that’s precisely when Barstool Sports founder Dave Portnoy decided to try day trading.

Sports Bettors Bottom Fish Ugliest Stocks

By his own admission, Portnoy had only ever traded one stock before taking on the market this spring. But despite his inexperience, Portnoy successfully channeled a master of contrarian investing.

In 1815, Baron Rothschild made a small fortune in the panic surrounding the Battle of Waterloo. He is also credited with saying,

“Buy when there’s blood in the streets, even if the blood is your own.”

Portnoy was in an enviable position as the market cratered. Earlier this year, Penn National Gaming bought a stake in Barstool Sports for $163 million. So, Portnoy had plenty of dry powder to invest at market lows. Portnoy also had a willing army of compatriots — bored sports bettors.

Portnoy live-streamed his experience under the moniker Davey Day Trader Global (DDTG), with the warning, “Don’t trust anything I say about stocks.” But like the Pied Piper, thousands of sports bettors followed him into some of the most beaten-down stocks in the market. Airlines, casinos — even cruise lines — found favor with the sports betting herd.

My son just told me that he can only play @FortniteGame in the evening… because half of his squad started trading. He is 10. @RobinhoodApp #TrueStory

— Joseph S. Mauro (@jsmauro13) June 9, 2020

As more investors piled into unloved sectors, the higher their stocks rose. As they rose, more amateurs answered the market’s siren call. Day trading has become so popular, in fact, that gamers are having problems getting a crew together during market hours.

Wall Street’s Big Money Caught Off Guard

The trading platform Robinhood added three million new accounts in the first four months of this year. Half of their new customers said they were first-time investors. In March, ETrade added 260,000 new accounts, which is more than it usually adds in a year.

The move into the market — and into some of the market’s most unloved sectors — caught Wall Street’s institutional investors off guard.

Legendary investor Warren Buffett announced he had dumped all his airline stocks just as Portnoy urged his followers to take to the skies. Buffett ended up selling low as day trading sports bettors profited. Portnoy said the 89-year old icon was “washed up,” raising the hackles of Wall Street’s elite.

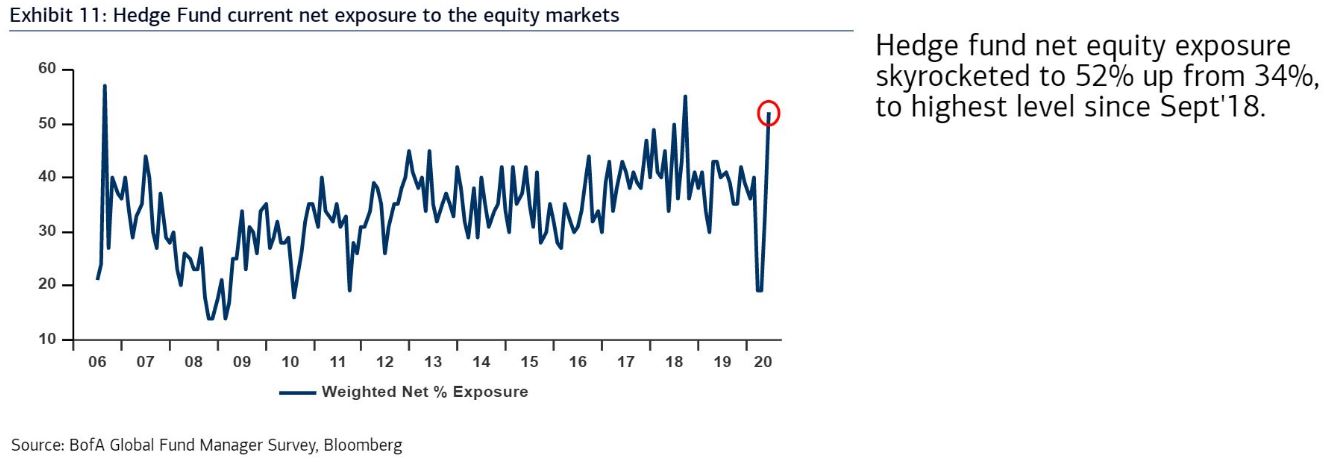

But Buffett wasn’t Portnoy’s only victim. Many hedge fund managers took cover in bonds or were hoarding cash, waiting out the recession that surely would come. On average, hedge fund managers had only a 34% exposure to stocks when day traders pushed the market higher.

For hedge fund managers, missing out on a rally is as painful as experiencing a downturn. They earn big fees based on their ability to beat the market. As a result, when the market rallied, hedge fund managers had to scramble to get back in.

So, add hedge fund managers to those who want sports to start up again — if only to get sports bettors back into sportsbooks and out of the stock market.